Our proprietary Fintech platform, Mosaic, provides a quantitative, auditable and automated foundation for our Monitoring and Consultancy services.

Every quarter, we share an update on this intelligent investment hub, from challenges we may have faced and overcome, to how we are leveraging new technologies to fulfil our clients' requirements.

NEXT UP, Q1 2025 UPDATE...

Hello, Justin here, COO at Enhance. Welcome to the second in our quarterly series of product updates.

Following our previous update, where Tafadzwa, our Development Manager at Enhance, addressed how we perform dynamic mandate compliance, we're excited to introduce our newest service: Investment Bookkeeping for trustees.

Image: Justin Simpson, Chief Operating Officer

Before diving into the details, I'd like to provide context on the benefits of our new service.

THE BOOKKEEPING CHALLENGE FOR TRUSTEES

Thank you for your positive response to our first product update. Today, we're addressing another significant challenge faced by professional trustees: the complex and often costly task of investment bookkeeping.

Professional trustees oversee a wide variety of investment portfolios that span multiple asset classes, currencies, and instruments. Each portfolio generates numerous transactions that must be accurately recorded in administration systems. Traditionally, this has been a manual, time-consuming process prone to human error and inconsistencies.

Our new Investment Bookkeeping service complements our established Monitoring and Consultancy capabilities, creating a comprehensive solution that helps trustees oversee investments and streamlines their administrative workload.

Michael Moretta, Director at Enhance, explains: "Over the past few years, we've received consistent feedback from trustees seeking a more cost-effective solution to their investment bookkeeping challenges. Their manual processes aren't just time-consuming; they were creating unnecessary risk and diverting resources from core trust management activities.

"Our new Investment Bookkeeping service directly addresses these pain points with a more efficient and accurate solution than traditional approaches."

Dr Ruzhen Li, Managing Director at Enhance, adds: "We're committed to staying at the forefront of innovation in the fiduciary technology space. The launch of our Investment Bookkeeping service represents another significant step in our journey as an industry leader.

"By seamlessly integrating verified investment data with administrative systems, we're not just solving today's challenges - we're creating the foundation for tomorrow's trust administration solutions. This integration of monitoring and bookkeeping capabilities, alongside our investment consultancy proposition, puts us in a unique position to serve the evolving needs of professional trustees."

INTRODUCING INVESTMENT BOOKKEEPING FOR TRUSTEES

Our new Investment Bookkeeping service leverages Enhance's data processing capabilities to transform how trustees handle investment data. The service offers three core benefits:

1. Independently verified data

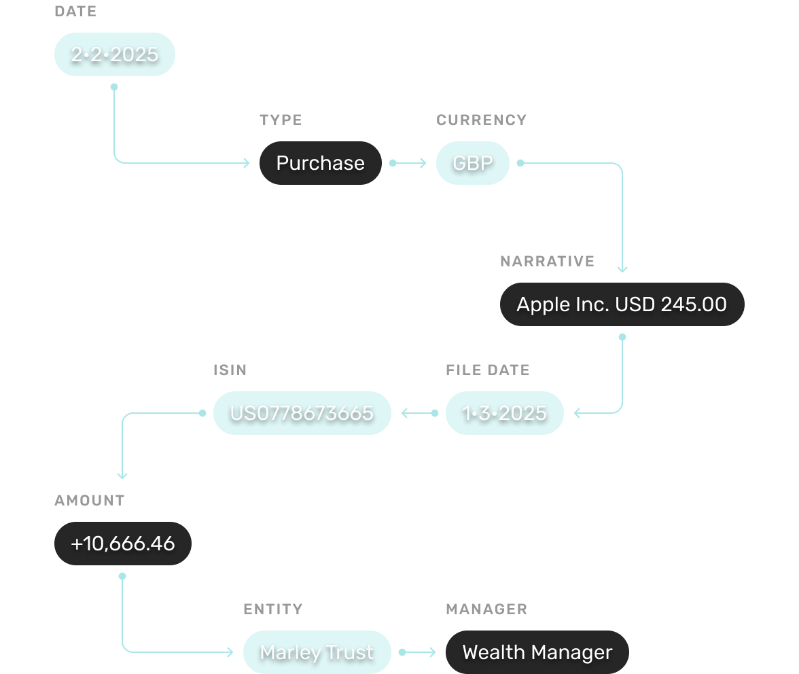

Investment portfolios are actively traded across multiple asset classes, currencies, and instruments, making bookkeeping a complex exercise prone to human error. Enhance transforms transaction and holdings data for each portfolio we monitor into an independently verified and standardised data pack that will accurately populate any bookkeeping ledger.

2. Automated process with standardised delivery

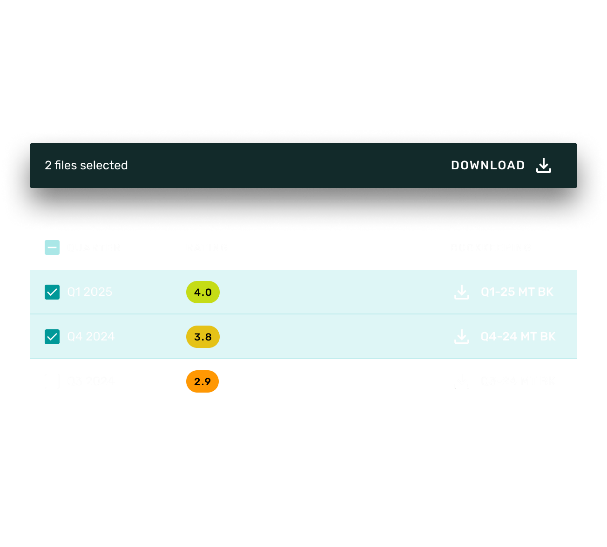

Manually inputting holdings and transaction data into an administration system is time-consuming and costly for fiduciaries and their accounts teams. Our automatically mapped data, available for download from Mosaic's Client Portal or via a data feed integration, saves time and reduces cost by pre-populating client ledgers in any trust administration and accounting system.

3. Quantios Core integration

Our exclusive integration with the Quantios Core system provides straight-through data processing for investment portfolios to some of the world's leading fiduciary firms. The two-way integration seamlessly delivers bookkeeping data and associated portfolio analytics directly into Quantios, enabling our fiduciary clients to consume our full Monitoring service in their core system. Action point management is another feature of the Quantios integration...but that is a topic for another day.

TECHNICAL IMPLEMENTATION

Behind the scenes, our Investment Bookkeeping service employs several sophisticated processes:

+ Data Normalisation: Probably the largest challenge currently; we standardise transaction data from various investment managers into a consistent format, ensuring uniformity regardless of the source.

+ Reconciliation Engine: Our system automatically cross-references and validates data points against multiple sources to ensure accuracy.

+ Format Transformation: Data is converted into formats compatible with leading trust administration systems, eliminating the need for manual reformatting.

+ Secure API Connections: For systems like Quantios Core, we've developed secure data connections that maintain data integrity throughout the transfer process.

BENEFITS FOR TRUSTEES

By implementing our Investment Bookkeeping service, trustees can:

+ Significantly reduce manual data entry

+ Minimise reconciliation discrepancies

+ Free up valuable time for higher-value activities

+ Improve reporting accuracy and consistency

+ Maintain a clear audit trail of all investment activities

+ Access a unified view of investment performance and bookkeeping data

LOOKING FORWARD

As we continue to evolve our service offerings, we're focused on creating an ecosystem that addresses the full spectrum of trustee needs. In our next update, we'll explore enhancements to our client portal to further improve the client experience.

We welcome your feedback on our new Investment Bookkeeping service as we continue to refine and expand its capabilities.

Please contact your Enhance relationship manager for more information or to schedule a demonstration of how Investment Bookkeeping can benefit your organisation.