Our proprietary Fintech platform, Mosaic, provides a quantitative, auditable and automated foundation for our Monitoring, Portfolio and Consultancy services.

Every quarter, we share an update on this intelligent investment hub, from challenges we may have faced and overcome, to how we are leveraging new technologies to fulfil our clients' requirements.

FIRST UP, Q4 2024 UPDATE...

Hello, Tafadzwa here, Development Manager at Enhance. Welcome to the first in a quarterly series of product updates.

In this edition, we’ll be addressing a key challenge faced by most of our clients (more details on this below). In upcoming updates, we’ll explore how we’re leveraging new technologies or making quality-of-life improvements to Mosaic.

Image: Tafadzwa Demba, Development Manager

Before focusing on the technical details, Justin Simpson, our COO, provides some context on the challenge we're solving: navigating variations in investment mandates; a common issue for our clients who manage diverse portfolios with unique requirements, tolerances, and restrictions.

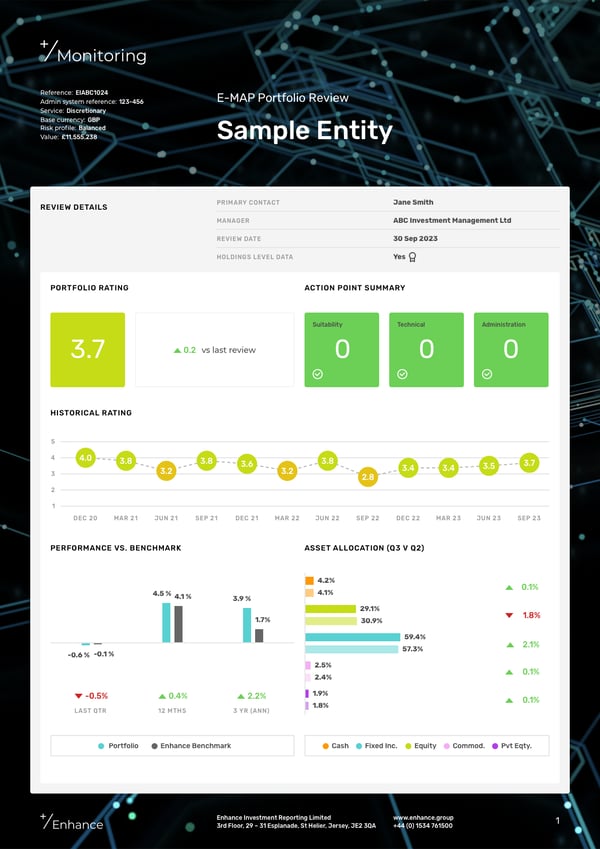

Justin explains: "Since 2005, our Monitoring service has provided a solution to clients' general investment monitoring requirements (typically Trust Companies) by providing a consistent framework regardless of the appointed investment manager/adviser. A core outcome of our approach has been producing content that is specifically designed for the receiver, using easy-to-understand terminology, with a thoughtful approach to design.

"Over the years, we have introduced new and interesting ways to monitor portfolios, including at scale, such as the update we introduced in early 2024 (Rise Of The Machines) through our EMAP+ framework."

Image: EMAP+ Portfolio Review Sample

"Being open to client feedback, it became clear to us very quickly that the EMAP+ framework provided TOO many results in many cases. Over the last few months, we have been working with several clients to solve this challenge, with the outcome being dynamic mandate compliance.

"I’ll hand back to Tafadzwa to give more insight into the technical approach used to help us and our clients with dynamic mandate compliance."

INTRODUCING DYNAMIC MANDATE COMPLIANCE

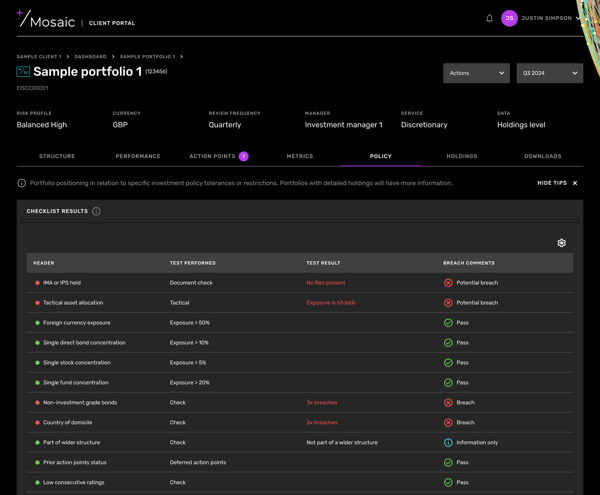

Each investment portfolio in Mosaic now benefits from a highly customisable set of investment

requirements, tolerances, and restrictions. These parameters are stored within each portfolio’s

profile, with the flexibility to standardise them at the client level for consistency.

Image: Mandate Compliance Table Sample from Mosaic's Client Portal

Dynamic Mandate Compliance allows us to:

+ Monitor highly specific investment criteria/restrictions for each client

+ Dynamically update the items included in PDF reports and the client portal

+ Maintain consistency while catering to individual requirements.

PROGRAMMATIC PROCESS BEHIND A DYNAMIC MANDATE COMPLIANCE

When a checklist/report generation is triggered, Mosaic systematically evaluates the portfolio’s

compliance using the following process (simplified for the purpose of this publication):

+ Fetching Relevant Rules: the system retrieves investment mandates either from the client-

level settings (which apply to all portfolios) or from the specific portfolio’s customised

settings

+ Applying Threshold Checks: it evaluates portfolio data against predefined conditions, such

as...

- Monitoring an asset class range (e.g., equities must stay between 30–60%).

- Limiting exposure to non-investment-grade bonds (e.g., max 10%).

+Generating Compliance Results: each criterion is assessed and assigned a status of Pass,

Fail, or Info based on whether it meets the defined thresholds

+Compiling the Report: the results are structured dynamically for presentation, ensuring

clarity in both PDF reports and the interactive client portal

REPORT GENERATION

It may seem surprising, but generating PDF reports presents one of the biggest challenges - primarily due to the fixed nature of page layouts. Unlike digital platforms, where content can adapt dynamically, PDFs require precise formatting to ensure legibility while fitting within limited space. Managing pagination, especially for complex financial data, adds another layer of difficulty.

Using our in-house-built custom solution, we have managed to overcome this challenge, enabling our clients to receive insightful and well-formatted PDF reports without compromising on clarity. In contrast, producing reports for our client portal allows for greater flexibility, enabling interactive and real-time data presentation.

As we continue evolving our reporting capabilities, expect a stronger focus on digital-first

solutions. Stay tuned for an upcoming update on enhancements to the Client Portal.

To contact Tafadzwa and the Development Team at Enhance, EMAIL US.