In a year that brought many challenges, I wanted to use the first #TechTuesday post of 2021 to reflect on the wonderful achievements by Enhance Group and the development team in particular, and acknowledge some of our key partnerships made, or strengthened, over the year.

The successful launch of the brand-new version of our proprietary platform, Mosaic, at the end of March 2020

Yes, just as we were going into lockdown in Jersey…a daunting prospect at the time but necessary. We were very pleased to achieve this strategic milestone.

The growth of our in-house development team

We developed from a team that was fully-outsourced, to an internal group of four immensely talented and intelligent developers (who work collaboratively with our wonderful outsourced partners, Infuse Group).

The incorporation of a semantic versioning system

Since the launch in March, we incorporated a semantic versioning system with the following releases over the year:

- Two major versions (Version 2.0.0, which was released in November, introduced the ability to report on portfolios with loans i.e. gross and net reporting)

- Five minor versions

- Sixteen patch versions

And a few more stats from our production site for the developers out there…

- Commits: 1,240

- Pull Requests: 1,017

- Additions: 68,286

- Deletions: 34,872

In association with investment analytics geniuses, FinMason, we introduced Holdings Level analytics to our capabilities

These allow us to report to clients on a wide range of exposures and calculated statistics within their portfolios. This also means, for example, that we are now able to programmatically monitor a portfolio for exposure or deviations across a massive variety of data points to ensure adherence to an investment policy statement.

The introduction of a Client Portal and Investment Manager Portal in Q4 2020

Although we are proud of these, we do consider them to be beta versions and users of these will see notable facelifts in 2021. More details to follow in a future update…

Our partnership with Lipper and Morningstar

This brought our clients access to >500 peer group indices and >10,000 market indices for inclusion in client reports – I have every confidence that we can build any benchmark from this range.

So, a huge thank you to our talented development team, as well as our valued partners, for helping to make 2020 a memorable year...for all the right reasons!

Looking ahead to 2021, this #tech series will be adapted slightly, with monthly updates (rather than weekly), including a post from development manager, Jamie Le Brun, once a quarter. My monthly posts will be a little more detailed than the weekly posts from 2020, and will typically introduce a new feature or interesting issue we’ve solved.

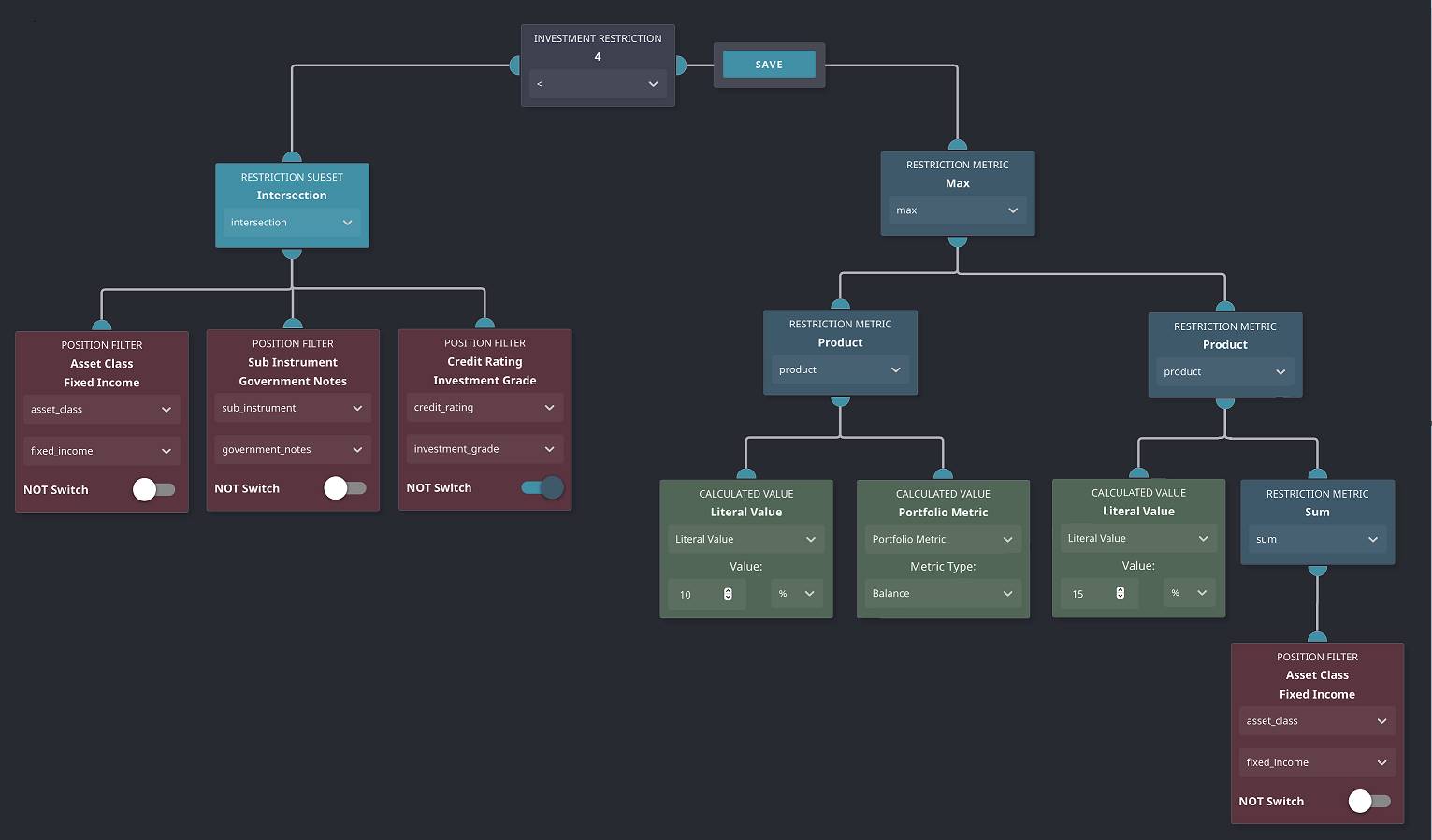

And just before signing off, I wanted to share a sneak preview of our – soon to be released – Investment Restrictions module. This brand-new module is the most interesting and uniquely challenging module that the team have built so far and will be the focus of my next post.

Challenge: a corporate gift to the first person that can accurately explain the investment restriction depicted…