In my post on January 5th, I introduced a sneak peek of our new Investment Restrictions module. This included a screenshot of a restriction which is not hugely uncommon in portfolios that we monitor, but when laid out structurally is actually relatively complicated to build; especially once you add the requirement for variability on a plethora of investment restrictions that could be applied to any given portfolio.

Well done to Richard Sayers, one of the founders of Enhance, for being the first to correctly translate the investment restriction!

When it comes to performing certain functions whilst monitoring an investment portfolio’s suitability relative to a mandate or investment policy statement (IPS), there is a clear desire to perform these functions accurately, at speed and, if possible, at high volume. These ensure we are focused on key risks to our clients as quickly and effectively as possible. As a FinTech, we seek to meet this challenge through thoughtful use of technology. I will review some of the other challenges presented to us in future posts.

Examples of investment restrictions we see regularly:

- Restriction on holding assets with a specific geographic situs (e.g. no UK or French situs assets)

- Limit on exposure to certain instrument types, individually and/or in aggregate (e.g. structured products or hedge funds)

- Income and capital to remain separate (e.g. funds to have obtained ‘distributor status’ in prior years, and seeking to maintain this going forward)

- Weighting restrictions on individual securities (e.g. no more than 5% of the portfolio value in a single equity)

- Credit quality constraints on fixed income securities (e.g. sub-investment exposure limited to less than 10% of the overall portfolio value)

- Tactical ranges (tolerances) at a headline asset class level (e.g. equity exposure to be between 25% and 65%)

- Currency exposure limits (e.g. non-base/reporting currency to not exceed 50% of the overall portfolio value)

Many of these restrictions require additional layers of information for each position held within a portfolio or the aggregations (of subsets or in total) of the portfolio, which is where data enrichment is introduced (a fascinating topic, but for another post!).

We have developed several components that allow a portfolio review to be matched against a set of complex criteria, thus testing whether any breaches have occurred.

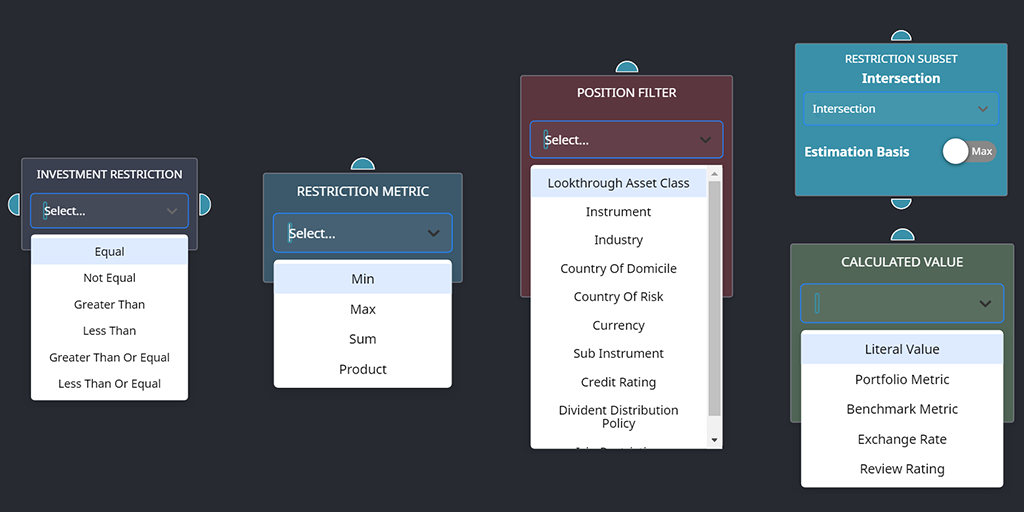

The components in brief:

- Investment Restriction

An element which compares two inputs (restrictor/restrictee), which may be any one of the components mentioned. Two special cases exist for this element. One of these elements is always the root of the graph structure in this case, if the resulting condition evaluates to true then a breach has been found.

- Restriction Metric

An element which performs some aggregation operation on a set of values. Currently supported operations: Product, Sum, Min, Max.

- Position Filter

An element which can be used to select positions (holdings) of a portfolio that match a specific set of criteria.

- Restriction Subset

An element which can combine multiple position filters. The combination can take two forms, either a union or intersection. A union selects all elements of the component's descendants, whereas an intersection selects only the positions that occur in all of the component's descendants.

Both require an option ‘estimation basis’, this is used to provide context to the calculation. Due to incomplete data enrichment properties, the estimation basis will be set by the Enhance author such that, in the context of the entire comparison, whether a lower or a higher value would be more likely to trigger a breach.

- Calculated Value

A versatile element providing the context to which investment restrictions are based upon. Options include:

- Portfolio metrics: balance, returns, volatility maximum drawdown (and associated time periods)

- Literal values: a specific figure or percentage

- The exchange rate between any currency pairing

- The Enhance rating (the quantitative score applied by Enhance based on the portfolio results relative to the primary benchmark)

It is clear to see that considered use of these flexible elements can recreate just about any investment restriction. Screenshots of the various components are included below.

We look forward to rolling out this new functionality to all clients in the coming months.