"Out of stock" - the options for low risk investing are disappearing

Historically, low risk investing was a simple exercise in placing cash in a bank deposit account or investing in government bonds to generate returns of somewhere between 2-5% per annum. In addition, fixed income has always been an important building block to construct a well-diversified multi-asset portfolio, and the skills of an active fixed income manager are well regarded and rewarded given that making a call in fixed income is believed to be more difficult than equity. I still remember the rather headache-inducing “bootstrapping” calculation and the overall daunting fixed income section in my CFA exams. In fact, fixed income attracted such industry awe that the (then) ultimate bond investor Bill Gross was crowned the “Bond King” and lauded by institutional and private investors alike.

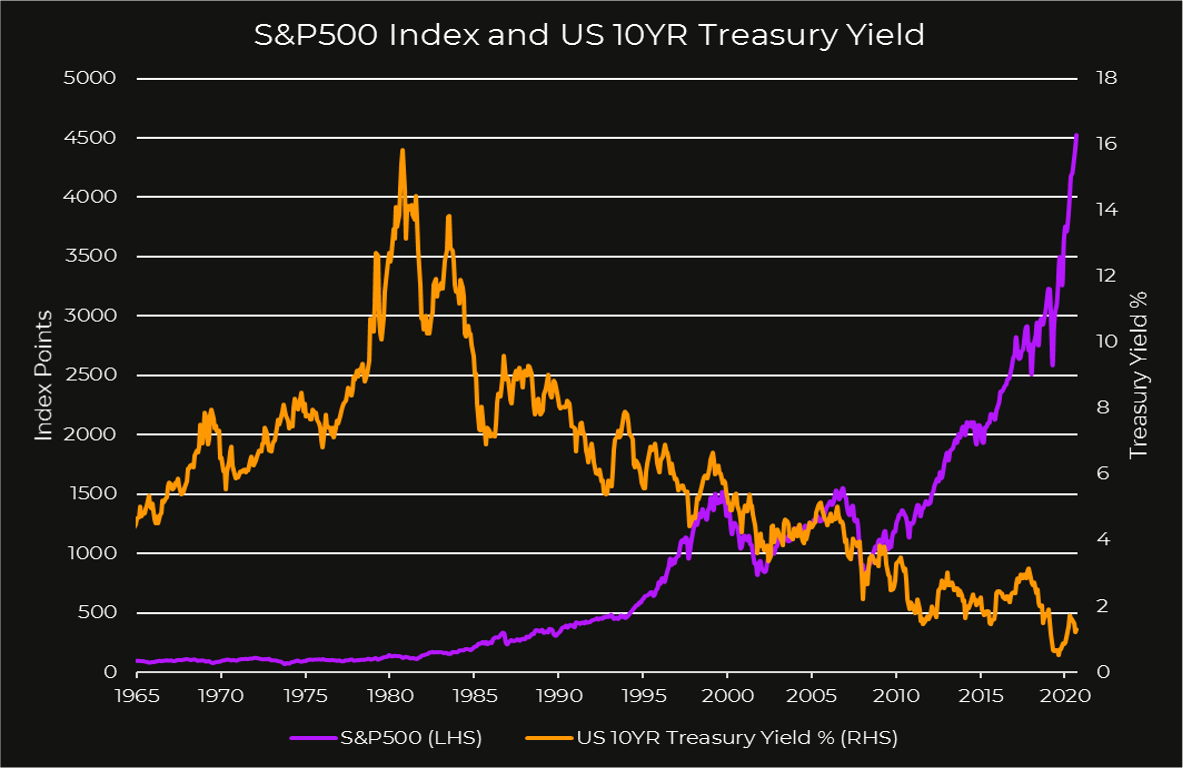

We have had a long bull market for fixed income with bond yields compressing consistently since the 1980s (see graph below), meaning that the income return achieved from bond investing is much lower today than it has been for a generation. Since the GFC, huge quantitative easing from central banks has impacted asset pricing much more than the real economy, leading to the GFC recovery being named the most “loved and hated” in history. If equity is now “loved and hated”, I would describe fixed income as “hated and feared” - especially for low-risk investors who do not wish to venture into the equity markets and accept all the volatility that comes with it. This is because equities in theory do not have a price ceiling, but fixed income does. As yields move lower and lower, the future risk and return trade off moves more and more against investors.

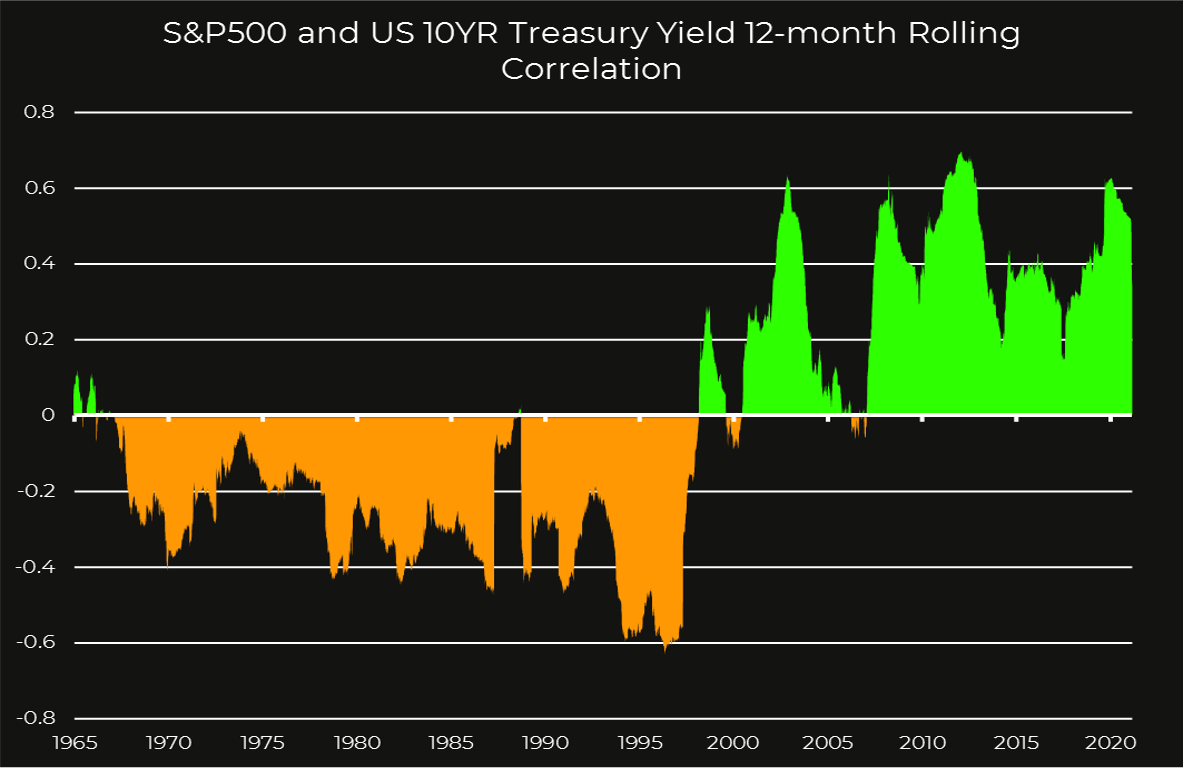

There is now an increasing correlation between equity and fixed income returns (see graph below) undermining a basic and longstanding diversification benefit enjoyed by counterbalancing equity risk with a steady and predictable fixed income allocation. If investing in equity is high risk and potentially high return, investing in bonds now could be considered high risk and potentially no return given slim yields, capital volatility and susceptibility to rising interest rates. And yet there are so many forced bond investors who have no choice but to hold these assets that they know full well wont deliver them much in the end. This has led to an unfortunate irony where lower return mandates are harder to deliver, in particular on a net of fee basis. When a large part of the investable universe is not a viable option, what else can you do to fill the “non-equity” bucket?

Hedge funds are not for everyone and don’t deliver income, Real Estate funds are either illiquid or demonstrate equity-like volatility and other idiosyncratic investment universes such as insurance products are not large enough to have a meaningful allocation. Hence most ‘balanced’ multi-asset managers are simply holding cash or equivalent while hoping that outperformance in their equity holdings will make up some of the cash drag. However, this strategy is not an option for low-risk managers as the “non-equity” bucket is traditionally set at more than 60% of the total portfolio. So these managers will either have to be extremely good at getting in and out of the equity market at the right time to maximise returns on a small allocation to equity risk or be very original and creatively construct the portfolio.

This doesn’t leave investors in a very comfortable position - “not investing” is not an option because cash will surely not keep up with inflation. Low risk investing is a hard task with a low success rate in the current environment and higher risk investing faces the spectre of inflated valuations and a correction as equity markets keep ticking higher… So our advice? All investors will need to adjust their expectations by asking for less return from their portfolios for a given level of risk (volatility or drawdown profile) or be prepared for more frequent peaks and troughs than in the past in order to generate an acceptable return. Stretch out the investment time horizon wherever you can because the old adage ‘what goes up, must come down’ is juxtaposed by history, which suggests that markets will always recover if you retain exposure to it for long enough.

Now it is more important than ever to truly understand and question fixed income allocations in your or your clients portfolios. A conventional low risk investment mandate may not be as low risk as you might reasonably expect, making proactive oversight of investment managers invaluable.