Sign up to our newsletter

Subscribe to our mailing list to get the latest insights, news and market updates delivered direct to your inbox.

Is resolution now in sight for 2020’s uncertainties? The US election finally delivered a clear result; the UK government agreed a Brexit deal; and, most importantly, coronavirus vaccines are being rapidly deployed.

Vaccines offer a pathway back towards normality, but administering the vaccine in sufficient numbers worldwide will be enormously challenging. There has been an impressive start, but it may well be late 2021 before widespread protection is achieved. Meanwhile, the virus rages on. The current wave is worse than earlier peaks, with global cases rising over 500,000 daily, and nearly 2 million deaths recorded. Healthcare systems are under extreme strain, with hospitalisations far higher than in the spring, forcing renewed restrictions, such as the UK’s recent strict lockdown.

The rapid emergence of multiple vaccines is unequivocally positive, but there are dark days ahead. Lockdown fatigue, vaccine scepticism, overstretched hospitals and logistical challenges could make the path back towards normality very bumpy.

The debate over what a new “normal” will look like has barely begun. The aftershocks of 2020 will echo for years, redefining how we live, work, travel and socialise.

After the long Presidential election count, Biden’s win was clear. It may still be disputed by Trump and hardcore supporters (with shocking recent scenes in Washington, D.C.), but Biden’s victory is now recognised in law. Democrat victories in Georgia hand Biden a narrow Senate majority: he will have a freer hand than many expected. Biden’s early priorities are clear: mandating masks, re-engaging with global climate action, and eliminating some tax cuts for the super-wealthy. Other priorities – like infrastructure investment, and COVID stimulus payments to households – depend on Congress and risk Republican obstruction. So far, markets seem relaxed about the prospect of Biden’s policy plans.

Britain finally avoided a catastrophic no-deal Brexit. The deal supports trade in goods, albeit with new frictions like customs declarations and border checks, but offers less for services. The government’s Office for Budget Responsibility (OBR) forecasts that exiting the single market and customs union means a cumulative long-term 4% GDP hit, but at least their estimated additional 2% immediate hit from a no-deal Brexit has been avoided. With elements of the deal up for periodic review, debate over the UK-EU relationship will persist for decades.

Would the gift of 20/20 foresight have helped investors in 2020? Forewarned of a global pandemic and lockdown, a brutal recession, surging bankruptcies and collapsing profits, plus a contested US election result and a near-miss on a no-deal Brexit, who would have embraced equities? Yet stocks have shrugged off these concerns to reach record highs, fuelled by massive monetary and fiscal policy responses to the pandemic: from central bank QE and commitments to low interest rates, to government loans and cash grants.

There have been policy missteps, and clear financial hardship for many, but overall policymakers’ decisive action has prevented recession becoming depression.

November was the best month for global equities since 1975. Stocks rose 13% as Pfizer, Moderna and AstraZeneca announced successful vaccines. For the full year, global equities gained around 16%, but what an extraordinary journey! Q1 saw a historic bear market, of similar scale to the crash of 1987 and the 2008 crisis, but faster than both; global stocks falling 34% in barely a month. April onwards saw a record rebound, the fastest ever recovery from a major bear market, with stocks now 50% above their March lows.

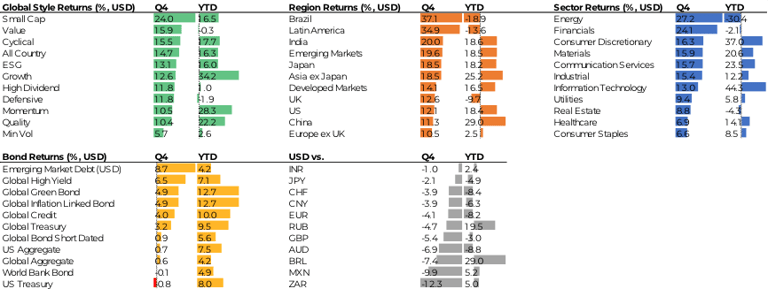

We have worried about market concentration, with performance driven by a few American and Chinese tech stocks. For 2020 as a whole, global tech rose 40%, consumer discretionary stocks, led by Amazon and Tesla, gained 36%; China gained 30%. However, Q4 saw market action broadening and rotating. Vaccine developments helped investors look beyond tech, towards stocks where recovering profits aren’t yet priced in. So technology, growth, the US and China, lagged in Q4 and previous laggards like Brazil (+35% in USD), US small-caps (+30%), value, financials (+24%) and energy (+27%) rebounded strongly. Elsewhere, UK small and mid-caps rallied sharply on Brexit deal relief. After the Q4 rally, 8 out of 11 global market sectors are positive for the year (all except energy, real estate and financials); and nearly all key regions show gains, outside Latin America, Russia and the UK.

British equities have been serial under-performers, despite a Q4 bounce, lagging global equities by over 7% annualised over a decade. Brexit and COVID partly explain recent underperformance, but sector composition also matters: the UK market has high weights in financials and energy, and virtually no technology. The UK’s traditional appeal as a high yielding market has also been tarnished, with dividend payouts falling sharply over the last two years. Overall dividends should recover somewhat in 2021, but remain narrowly based, with half derived from just ten companies, including energy, mining and tobacco stocks, prompting some sustainability concerns. UK stocks will have days in the sun, perhaps in 2021 if value rotates into fashion, but emphasising global diversification has served UK investors well.

Japanese equities surged in Q4, overtaking global indices for the full year. New premier Suga has seen approval ratings fall recently, but investors remain focused on market-friendly reforms. Markets are pleased by Japanese companies increasing dividend payouts and focusing on return on equity.

A key question for 2021 is whether the value rebound is the start of a durable trend. Value has lagged growth for years, and valuation divergences have become extreme. Some investors draw comparisons to the late 1990s technology bubble, wondering how long to keep holding expensive growth stocks. Others maintain growth can keep outperforming, that value stocks cannot sustainably recover until we see growth, inflation and bond yields rising.

Traditional safe havens like the US Dollar, government bonds and gold performed well in the first quarter and, in some cases, well beyond: US 10-year Treasuries yields fell to 0.5%, driven by central bank policy, and gold peaked over $2000/oz (both in early August). From April onwards riskier assets consistently outperformed. Even oil prices, crushed in the spring by collapsing transport demand, have recovered to around $50/bl in late 2020. Corporate bond spreads recovered as it became clear bankruptcies would not reach 2008-9 levels. For higher-rated corporates, credit spreads have tightened towards record levels. Riskier “junk” bonds and emerging market bonds performed strongly in Q4, and now show healthy gains for the full year. Inflation-linked bonds were 2020’s standout performers, with US TIPS and UK linkers returning double-digits. They benefited from safe haven demand in Q1, and have continued to gain since with investors paying up for protection from long-term inflation risks.

The US Dollar peaked in Spring, as investors sought safe havens, and has since suffered a broad retreat. All major currencies and almost all emerging market currencies appreciated against the Dollar in Q4. Sterling rose over 5%, supported by the Brexit agreement, taking it to a small gain for 2020. There were rebounds in Q4 for vulnerable currencies like the Brazilian Real, Turkish Lira and Russian Ruble, though all still show significant full year losses against the Dollar.

Despite the weak Dollar, Gold was flat for the final quarter, but there were explosive rises in Bitcoin and other crypto-currencies. Bitcoin quadrupled in 2020, to around $30,000. Many sceptics remain: some fear a speculative bubble or worry about Bitcoin’s volatility. However, Bitcoin is seemingly becoming mainstream, with more banks offering services, Wall Street strategists citing it as a global currency, and more institutions making investments.

In a world of US Dollar weakness, emerging markets typically do well. A weakening Dollar boosts liquidity, eases pressures on some vulnerable borrowers, and can support risk appetites. Emerging equities have indeed outperformed, driven by China, Korea and Taiwan, finishing 2020 in touching distance of new highs. EM indices have evolved significantly over the years, gaining exposure to Asia and technology, and reducing exposure to Latin America, Russia and commodities, but have never regained 2007 highs, despite a couple of near misses; perhaps a weakening Dollar will deliver a final push.

The arrival of vaccines, after the waves of unprecedented monetary and fiscal support, shifts the balance of risk and reward, dramatically reducing the potential worst-case scenarios. Global GDP will have shrunk around 4% in 2020, with developed countries, particularly the UK and Eurozone, doing worse. Most forecasters see a significant rebound in 2021, led by Asian economies. Surveys show that services businesses are still suffering from lockdown restrictions in the US and Europe, but look more robust in Asia. In manufacturing, surveys confirm global recovery but also reveal inflation pressures, due to rising input costs and surging freight rates. Climbing infections and renewed lockdowns may shake confidence but 2021 should deliver meaningful economic growth as vaccines tame the virus.

Concerns persist that government borrowing to fund the COVID response will undermine recovery, forcing an early removal of fiscal support. For now there is no sense of crisis: central banks remain in control and near-zero bond yields keep debt service costs low.

Investors face many challenges in 2021. The virus could spring further surprises, or the vaccine rollout could miss expectations. Policymakers have a difficult path to steer. Current inflation is low but any hint of a rise may be enough to spook investors, and fiscal hawks in the UK and elsewhere may undermine market confidence in ongoing government support packages.

Market returns in 2020 were impressive, but consequently many assets look expensive. Optimism about recovery seems baked into prices already, for many equity sectors. Arguably stocks offer value relative to government bonds, with low or even negative yields, but this does not bode well for long-term returns from a multi-asset portfolio. Perhaps late 2020 shows that investors may look beyond defensive assets and high-tech winners, towards more cyclical equity segments, like Europe, Japan and Emerging Markets, and seek opportunities to embrace value. However, fears of returning inflation could undermine confidence, and low yields on government bonds and cash mean that managing portfolio volatility remains extremely challenging.

Subscribe to our mailing list to get the latest insights, news and market updates delivered direct to your inbox.