Three months ago, WHO data recorded 10 million infections and 500,000 deaths. By the end of September, the death toll had doubled, with 33 million infections worldwide, rising by around 300,000 a day. Seven million cases have been confirmed in the US, and over 200,000 deaths – more than any other country. Six months from the start of global lockdown, the second wave is decisively upon us.

There appears to be increasing acceptance that disruption is here to stay, and that some old norms may have gone forever. While governments are desperate to avoid repeating the Spring lockdowns, we face an evolving patchwork of local lockdowns, travel and social restrictions, and partial normalisation followed by partial reversal. Policymakers are seeking a delicate balance between public health and economic imperatives, but this may miss a deeper truth: failure to control the virus could force more draconian responses, causing more significant, permanent economic damage.

After catastrophic recessions in almost all major economies in Q2, the September quarter shows a strong, albeit partial, rebound. Manufacturing has led, with Purchasing Managers Index (PMI) surveys for September highlighting firms’ optimism and resurgent exports – with traces of inflation due to disrupted supply chains. Services’ recovery seems less convincing, likely hampered by social distancing rules, with the Eurozone especially losing momentum.

US payroll data shows around 22 million jobs were lost in March-April; about half have since been regained, but the pace of improvement is slowing. US unemployment has risen to 7.9%, from 3.6% in January. Workers have been protected in countries with effective furlough schemes: the UK’s unemployment rate has risen only modestly, to 4.1% in July, but the imminent replacement of furlough with a less generous scheme suggests that will rise. Consumer confidence collapsed across the globe in Spring but recovered meaningfully since: it is yet to be seen whether confidence will be robust enough to support spending as job prospects weaken.

As expected, Q3 shows a meaningful economic recovery with more sectors reactivating, but on fragile foundations and facing strong headwinds. Manufacturing has rebounded particularly strongly, but social distancing harms many services businesses, corporate bankruptcies are climbing and underlying labour markets are weak.

After the barrage of monetary and fiscal measures in March, new policy steps have been more limited. QE continues to pump liquidity into markets, and may yet be expanded: inflation remains low enough to give Central Banks flexibility: the Bank of England has confirmed that negative interest rates are in its toolkit, and the Fed’s shift to average inflation targeting suggests rates can stay lower for longer. Recent focus has been more on fiscal policy, particularly sector-specific measures. In America, the House has passed another stimulus bill authorising cash payments to households, but this still faces some hurdles. Germany’s fiscal stimulus dwarfs others; it could total close to 40% of GDP (compared to 23% for the UK and 15% for the US).

The flip-side of massive fiscal intervention is ballooning government debt and dramatically increasing debt-to-GDP ratios. This could undermine long-term government debt sustainability, but markets seem unconcerned. Central Bank bond purchases have helped capping yields: US ten-year Treasury yields were unchanged for Q3 at around 0.65%, and UK yields edged higher, leading to small losses for Gilts. US Treasury Inflation-Protected Securities performed well, returning 3% in Q3, reflecting a rise in inflation expectations.

Late July saw a bout of volatility in government bonds, reminding us these so-called safe-haven assets carry risks too: few viable alternatives to protect portfolios exist, but they are no panacea.

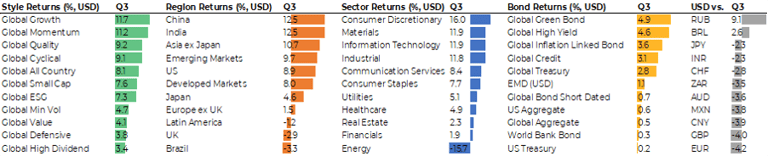

Hopes of sustainable economic recovery supported growth-sensitive markets: equities, corporate bonds, riskier currencies and industrial metals. But despite strong gains for Q3 overall, September saw a meaningful correction.

Riskier bonds outperformed again, consistent with ongoing economic recovery. US high yield returned close to 5% in the quarter (despite a rise in corporate defaults), with credit spreads initially narrowing before September’s correction. Emerging market bonds also continued their recovery, helped in some cases by Dollar weakness.

The Dollar fell 2-4% against most major currencies over Q3; even Sterling, previously a laggard, gained 4% on hopes the UK and EU will agree a basic deal before the Brexit transition period ends. Sterling could be volatile if uncertainty flares, and meaningful disruption to UK trade is possible in January if no such deal is signed. The safe-haven Dollar rallied strongly into March; those gains have since largely evaporated. Most emerging market currencies that we track rose against the Dollar, including strong gains for some commodity sensitive currencies, particularly those more associated with metals than energy (South African Rand and Chilean Peso).

While oil prices remained stable (close to $40/barrel for crude oil), prices of many other commodities strengthened. Gold grabbed headlines, with prices peaking above 2000/oz before a sell off into September, but many metals and agricultural commodities rose. While agricultural commodity price rises might be blamed on weather conditions, hopes that sustained economic growth could support demand drove notable rises for industrial metals like copper and aluminium.

Equities rallied further, with almost all markets making gains. The global equity index is now positive for 2020, driven by US, Asia ex-Japan and especially Chinese equities. China gained over 12% during Q3, and Japan shrugged off PM Abe’s resignation, gaining around 4%. In America, big tech still dominates, with the majority of YTD gains for S&P 500 ascribable to just five stocks (Apple, Microsoft, Alphabet, Facebook and Amazon). The Value segment lagged Growth substantially again. Brief periods of outperformance by Value seem to correlate with optimism about coronavirus vaccines; could a vaccine finally be the catalyst to end the extraordinary performance gap between the two styles?

The global consumer discretionary sector (driven by Amazon) gained 16% in Q3, but we saw cyclical materials and industrials matching the returns of global IT stocks (all +12%); recovering metals prices helped mining companies in the materials sector. The only negative sector was energy, falling 15% on demand and profitability concerns. Of the major national stock markets, only Brazil, Russia and the UK fell in Q3; all have high weightings in energy stocks. Significant further dividend cuts from FTSE companies also undermined UK stocks – and present significant challenges for income investors.

While stocks recorded impressive gains for Q3 overall, the peak came in early September followed by a sharp correction. The S&P 500 ended Q3 almost 7% below its peak. Whether this was a refreshing pause after extraordinary gains, nerves over an inflation scare, gravity’s pull on extended valuations or a more concerning retreat from the rampant virus remains to be seen.

We start October with markets’ focus increasingly on the US Presidential election. Opinion polling shows a clear margin in favour of Biden over Trump, but it’s unclear how Trump’s illness will affect the contest. Markets should be pricing in a Biden win, as well as some probability of the Democrats taking the Senate too. A clean sweep might bring forward stimulus spending focused on infrastructure and green energy, but could raise concerns about regulation and increased taxation. A contested result, with recounts and challenges dragging through the courts, could be a far more concerning outcome.

We ended Q2 noting tension between buoyant stock markets and investors’ wariness about equity market valuations, the sustainability of economic recovery, and the second wave of the virus. That economic recovery helped markets progress, but the return of volatility reminds us that investors’ concerns remain valid. When we write our next review in January, the uncertainties in the US and UK political landscape should at least be resolved; perhaps the prospects for a vaccine and the success of measures to control the virus and sustain the economic recovery will be clearer too.