Central Banks around the world continue to cut interest rates in an uncoordinated but synchronised response to slowing global growth and fears of falling inflation expectations. Emerging markets have eased aggressively all year, led by India, in a push to offset deflationary pressure being exported from China. Several countries contracted in the second quarter; Germany, UK, Argentina, Hong Kong, Russia and Singapore, while Venezuela and Iran remain in outright recession. US economic growth slowed to 2.3%, although holding above the ‘Maginot line’ of 2%, while China’s economic growth slowed to 6.2%.

In September, Mario Draghi held his penultimate ECB meeting as the bank’s President. He leaves on 31 October and will be replaced by ex-IMF chief Christine Lagarde. Being ‘Super Mario’ he clearly wanted to leave the ECB with the Italian spirit of ‘Veni, Vidi, Vici’ and so launched a mini monetary policy ‘Bazooka’. It included lowering the deposit rate by 10bp to -0.5% with a tiered scale to protect bank profits, a third TLTRO package of subsidised loans for banks, an open ended QE program of €20bn per month and a shift in forward guidance from a ‘date’ to a ‘state’, implying interest rates won’t rise and QE won’t stop until the ECB hits its inflation target.

The aggressive stimulus package from the ECB allowed the Fed to move again in September. The Fed cut rates for the second time this quarter, lowering the target range for the federal funds rate by another 25bp to 1.75 - 2 percent. The accompanying Fed ‘Dot Plots’ showed the FOMC has no majority for further rates cuts in 2019 and 2020. However, the market continues to disagree and is pricing in further easing. This suggests the Fed remains behind the curve primarily because after 50bp of rate cuts year to date the US yield curve has not steepened and the USD remains strong.

By contrast, the PBOC has only eased a little so far this year via a small reduction in the base interest rate and reserve requirement ratio. Economists expect the PBOC to begin easing further to offset the continuing negative effect that tariffs are having on economic growth. The US has placed tariffs on approximately US$350bn worth of goods imported from China and, in December, President Trump is expected to place tariffs on the remaining US$150bn of Chinese imports. 18 months into the China-US trade dispute and US equities have outperformed Chinese equities by 34% since the start of the ‘trade war’. The problem however of expectations of any meaningful further easing is that Beijing is fully aware that tariffs of 5%, 10% or even 25% on all Chinese imports to the US is not enough to hurt them economically; $500bn at 25% tariff would be $125bn which is only around 1% of China’s $12 trillion economy. What would hurt them economically would be a massive stimulus response akin to 2008 and 2015. Beijing is concerned about China’s current debt levels, given Japan’s two-decade battle with debt deflation, and therefore is being cautious.

Globally inflation remains ‘barbell shaped’. On one side there are high inflation areas in Venezuela (2,800,000%), Argentina (54%), Iran (42%) and Turkey (15%) and on the other side deflation areas in the UAE (-2.2%) and Saudi Arabia (-1.3%). The rest, excluding smaller frontier markets, are generally between 0-2%. The high inflation countries suffer from a vicious circle of money printing to finance government deficits, which results in a sharp currency depreciation, a spike in inflation, severe interest rate hikes, a collapse in economic growth and more money printing… Whereas the deflation countries are being affected by exogenous not endogenous variables. It is not a coincidence that the UAE and Saudi Arabia are in deflation, as the AED (UAE Dirham) and SAR (Saudi Riyal) are pegged to a strong USD which is causing deflationary pressure at a time when oil prices are also weak. The USD is strong because of a combination of relatively tight monetary policy, loose fiscal policy and safe-haven demand status.

In aggregate more countries are below their central bank inflation target, which is one of the core reasons for the global shift towards monetary policy easing.

However, towards the end of the quarter global bond yields have risen from their mid-August lows. The reason is twofold; better economic data has been coming through and a fall in geopolitical tensions. The Citigroup Global Economic Surprise Index has been continually surprising to the upside indicating economic data releases globally have been better than expected. Plus, JP Morgan Global Manufacturing PMI data may have bottomed, as the index recently posted its first increase in 17 months, indicating a potential end to the global manufacturing recession. Geo-political tensions fell on an increased probability of a US-China trade deal by year end, an EU-UK withdrawal agreement by October 31, the Italians successfully formed a new pro EU government and Saudi-Iranian-US tensions are unlikely to result in military conflict. In 1988, Iran Air Flight 655 was shot down by USS Vincennes, resulting in the death of all 290 passengers and crew on board. The US claimed it was a mistake as it took place during the heightened tensions of the Iran-Iraq war. Eventually in 1996 the US paid a financial settlement to stop the case going to The International Court of Justice. This puts into perspective the recent drone strike on Saudi oil facilities which resulted in no casualties.

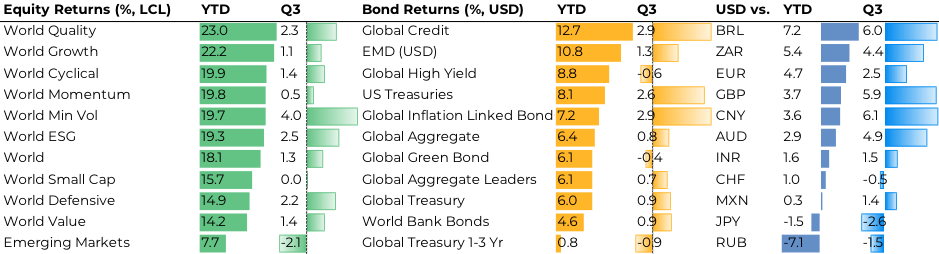

Global developed market equities have staged a strong recovery, led by cyclical assets, to end the third quarter in positive territory. Minimum Volatility outperformed on increasing investor fears of an economic slowdown. Italian BTPs outperformed as they were the target of the ECB’s Bazooka and not European core bonds. And in local currency terms, Japan was the best performing equity region given its highly cyclical makeup. UK Mid-caps rallied on a reduced likelihood of a no deal BREXIT. EM equities and Chinese equities continued to struggle delivering negative returns over the quarter. In fixed income, the standout performer was UK indexed linked government bonds due to their extreme interest rate sensitivity which captured the rally in UK bond prices as interest rates fell. Oil and Credit Spreads remained benign despite the rally and reversal in rates and heightened Middle East tensions. Gold continued to rally further on negative rates rising $150 to end the quarter above $1550 an ounce. The USD dollar rallied over the quarter as it remains the highest yielding G10 currency.