Sign up to our newsletter

Subscribe to our mailing list to get the latest insights, news and market updates delivered direct to your inbox.

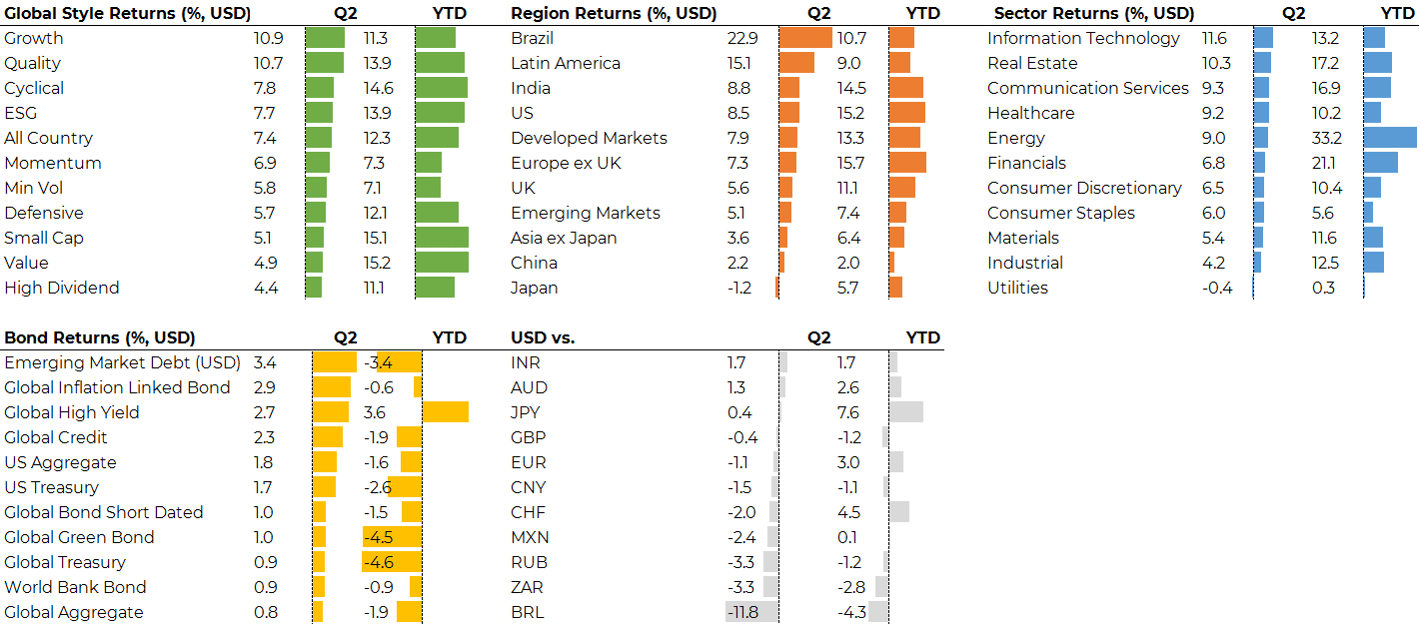

In Q2, financial markets, in both equities and bonds, almost made gains across the board, taking stocks to solid double-digit gains for the year to date.

Global equities gained almost 8%, supported by very strong earnings growth and booming business conditions as vaccine rollouts allowed more of the global economy to reopen. The advance was led by the US, Europe and by growth stocks such as the IT and Healthcare sectors. Small-cap and value stocks lagged, following very strong gains in Q1. Global bonds returned 1% as inflation concerns eased. Longer duration bonds, such as gilts and inflation-linked bonds, and higher quality corporate bonds performed well. Emerging market bonds were boosted by recovering currencies. Real Estate stocks gained over 11% in the quarter, helped by falling bond yields and the continued economic reopening; they were the strongest equity sector in Q2. Commodities rose strongly, led by oil and industrial metals: a broad commodity index gained 13% in Q2 and almost 20% year-to-date, supporting healthy gains from energy companies (up another 9% this quarter) and oil-sensitive markets including Canada, Brazil, Russia and Saudi Arabia.

Very few assets saw losses for the quarter. Japanese equities bucked the trend, with slightly negative returns in Q1 and Q2: slow progress on vaccinations and tighter restrictions after a surge in infections were headwinds. Chinese equities made marginal gains as policymakers continue to dampen debt demand, and Indian equities gained around 7%, helped by a retreat from April’s peak of coronavirus cases. Several smaller Asian and Latin American markets retreated in the quarter. Gold held onto a modest gain in Q2 overall, after a sharp fall in June wiped out most of its quarterly advance, but Bitcoin volatility continued: after breaking above $60,000 in early April, Bitcoin lost almost half its value, ending the quarter around $33,000. Such volatility continues to raise questions about its function as a store of value.

The reopening of major economies has created boom conditions. The US reported annualised GDP growth of 6.4% in Q1 and consensus expects an acceleration into Q2. Eurozone growth was negative in Q1, with many economies in renewed lockdown, but restrictions have eased and forward-looking indicators, such as Purchasing Managers Indices (PMIs), suggest a very strong rebound is in progress.

The flipside of a rapid rebound in growth has been a concerning rise in inflation. Surging demand has encountered supply shortages in raw materials, manufacturers and, in some cases, labour, forcing up prices. Firms are seeing the strongest pricing pressures for years through their supply chains. US CPI inflation reached 5% in May, raising some fears that the Federal Reserve would be forced to end its ultra-stimulative policy. However, many believe that the inflation surge is relatively narrow and transient, reflecting short-term factors that will soon fade: pressure on supply chains will ease as Covid restrictions are lifted, and demand will settle into more normal patterns as the surge of post-lockdown spending on previously forbidden pleasures passes. The rebound of oil prices may also have a less extreme effect on inflation data, as the anniversary of 2020’s extraordinary collapse is behind us. We may still face several months of relatively elevated inflation readings, but markets are not unduly concerned. After the first earlier passage of the $1.9tn coronavirus stimulus in March, the Biden infrastructure stimulus continues to make some progress through the House, albeit shrinking along the way potentially to below $1tn after initial hopes for over $2tn, but its inflationary implications may be offset by accompanying tax rises.

Crucially, the Fed has begun to subtly shift in its language, with some members discussing a “taper” (a scaling back of bond purchases) while reassuring markets that any such move would be gradual and affirming that interest rates will not rise before 2023. Managing the transition away from emergency QE bond purchases will be a key challenge for policymakers and could yet destabilise markets, but investors can have no complaints so far: the Fed has introduced the topic of the taper, with global stocks continuing to make new highs – quite a feat.

Equities have made stately progress so far this year, despite inflation scares, emerging coronavirus variants and the Fed tiptoeing towards a taper. Equity market volatility, as measured by VIX, has fallen to post-pandemic lows. In six months, the S&P 500 has gained 15% without a largest peak-to-trough drawdown of just 4.2%. This is not unheard of, but relatively unusual: there have been only 14 years going back to the 1950s, and only one year in the last twenty-five, without a US equity correction greater than 5% in the first six months. On each occasion - bar one (1986) - stocks have risen over the remainder of the year. Of course, precedents like this may mean little and periods of calm end eventually, but the current market trajectory does not need to signal danger.

If early 2021 was about reflation and recovery, the second quarter has seen increased confidence that inflation concerns will fade as the recovery spreads and the economy adjusts. If true, this has profound implications. Moderating inflation eases pressure on central banks to reduce stimulus in the economy: this helps stabilise bond markets and removes a headwind for equity valuations, particularly for growth stocks.

Lower US bond yields and the continued recovery in global growth have also weakened the US Dollar’s upswing, which risked becoming a source of instability. The Dollar rose 4% vs Euro, nearly 7% vs Yen, and gained broadly against almost all emerging currencies in Q1. With expectations reaffirmed for no US rate hikes until 2023, most currencies have stabilised and recovered a little against the Dollar in Q2: the Euro regained 1%, and many emerging currencies rebounded. The Brazilian Real, after significant weakness in 2020 and early 2021, bounced 13% against the Dollar in Q2. Sterling gained only marginally against the Dollar. While relief that a no-deal Brexit was averted supported the Pound in Q1, the dripfeed of newsflow about export challenges hitting UK firms and concerns about the recent surge in infections may have prevented a better Q2 performance.

Changes to the global corporate tax regime have been agreed between 130 nations, under the auspices of the OECD. There are two main pillars to the agreement, the first aimed at ensuring that large multi-national businesses pay more tax where they operate, limiting their ability to juggle profits to low tax jurisdictions, and the second looking to implement a global minimum tax rate of 15%. It is anticipated that implementation of the agreement would see tax paid by global multinationals (including large US technology companies) rise by an aggregate $100bn, with a higher overall share going to governments onshore, and less to jurisdictions offering aggressively low corporate tax rates. All of the G20 nations, including the US and UK (plus the Cayman and Channel Islands) agreed the proposals - although legislative passage - will be challenging in some countries, not least the US. However, some low tax jurisdictions, including Ireland and Estonia, refused to bow to pressure to sign. The full impact will take time to play out, but the effective diversion of $100bn annually from profits and shareholders to the global public purse could be significant.

With equity markets achieving record highs, and no meaningful correction so far this year, many investors are understandably focused on downside risks that could provoke volatility. Of course, there are many, with central bank policy and the progress of the pandemic dominating. Central banks have made clear their reluctance to withdraw stimulus too fast, even as the economy recovers, but inflation pressures could yet cause jitters, as markets look ahead to possible tapering of QE in the next twelve months and eventual interest rate rises in the subsequent twelve. The Fed has managed its communication well so far, but there is a long way to go. The transition from simply talking about tapering to actually beginning the process could be more challenging.

And the pandemic still rages: new daily cases recorded globally fell to around 350,000/day in June from over 700,000/day at the end of 2020, but the spike to 800,000/day as recently as April means that we are still vulnerable, especially when considering that there are more deaths in six months this year than 9-10 months of pandemic in 2020. The progress of vaccination programmes in the US, UK, much of Europe and latterly China is impressive and has given the authorities confidence to further reopen those economies, despite rising infections due to the Delta variant in some regions and the threat of other variants to come. For now, vaccines have prevented resurgent infections leading to overwhelming numbers of hospitalisations and deaths. The UK’s decision to ease restrictions further while infections are surging will be an important test case for others and it is to be hoped this does not result in a forced U-turn and renewed restrictions. Slower progress on vaccinations in Japan and many emerging economies leaves them vulnerable to new variants: the recent acceleration in infections in Russia, Indonesia and South Africa, among others, and the high levels of disease still prevalent in Latin America, suggest the road will still be a hard one.

In this environment, questions about portfolio protection and diversifiers remain very pertinent. We see a range of approaches across our favoured managers, such as gold, TIPS and alternatives, alongside traditional fixed interest. While some managers have looked to diversify and add selective exposure to Value stocks to portfolios, others have favoured the Growth style that outperformed significantly until the end of 2020. If the second half of the year sees taper talk intensify, and perhaps the first steps to wind-down the pandemic emergency QE, markets’ stately calm could be tested.

Subscribe to our mailing list to get the latest insights, news and market updates delivered direct to your inbox.