Sign up to our newsletter

Subscribe to our mailing list to get the latest insights, news and market updates delivered direct to your inbox.

Lockdown and Rebound

Life has been dominated by the COVID19 tragedy. Three months ago, World Health Organisation (WHO) data showed the pandemic accelerating: global infections rising 50,000 a day and deaths by 3,000 daily. At the end of March, over 750,000 cases of the disease had been reported and over 36,500 people had died; by now, the WHO has recorded over ten million infections (over a quarter of these in the US), with new cases rising by at least 150,000 a day, and the pandemic has claimed over half a million lives.

While the pandemic rages on, lockdowns are easing. In much of Asia, Australasia and Europe, growth in new cases has slowed considerably and has become characterised by localised outbreaks, with governments pushing ahead to reopen their economies. Elsewhere, notably the USA, Brazil and India, lockdowns are easing while the virus appears to be dangerously out of control. The situation in the USA appears deeply concerning: after a gradual fall in new infections through late April and May, new cases have spiked since mid-June as the economy reopened and are now being recorded at around 50,000 a day, far in excess of the April peaks. A second wave appears to be arriving before the first had receded. Across the world, we are faced with enduring uncertainty: how far off is a vaccine? What will cooler winter weather bring? How many more local lockdowns will we face? How long will governments pay furloughed workers? What will be the economic damage alongside the human cost?

After a violent sell-off in February and March, global equities bottomed on 23rd March and have since rallied 39%, even as the death toll climbed and the scale of economic damage became clear. Q1 GDP, reflecting only a few weeks of COVID disruption for most countries, fell sharply: -5% annualised in the US, -3.5% in the EU, -9.8% in China where the virus struck earlier; and government deficits are ballooning as tax revenues fall and emergency spending accelerates. Yet this devastation has been accompanied by a record-breaking market recovery: the S&P 500 recorded its biggest ever 50-day rally by early June, and has pushed on to mark one of the strongest ever 100-day rallies by 1st July, rebounding over 40%, a run not bettered since 1933 (we dissect the market performance in more detail later).

Of course, financial markets look far ahead, trying to price future cash flows, rather than the past or present. Equity bear market troughs do not generally coincide with the nadir of the real economy; stock markets often start to rebound many months before a recession has ended. More often than not, lows reflect a policy response that allows investors to look further ahead more confidently to an eventual recovery. Late March brought unprecedented, global policy responses that have underpinned markets: the surge of monetary policy measures, from interest rate cuts to asset purchases; the massive fiscal policy response led by income replacement payments to households; and the range of public health policy responses, that suggest the virus can be contained. More action may be needed, but having seen unprecedented policy steps already, markets now assume that policymakers will do more if needed.

We entered Q2 in lockdown, with economies freezing; we ended it with lockdown easing and economies thawing. There is tension between short-term public health objectives, favouring caution, and longer-term economic objectives, which call for early reopening. We have seen an economic recovery built on the progressive re-opening of more sectors in more countries through May and June, and markets are attempting to understand how broad, strong and sustained that recovery can be.

Retail sales data in the USA, Germany and UK have rebounded impressively. Other timely indicators, such as energy demand, traffic volumes and Google searches for house-purchase websites look promising, often nudging pre-lockdown levels, perhaps suggesting a V-shaped recovery. PMI surveys of business sentiment have surged across Europe, the USA and UK; in China, the Services sector PMI recorded a ten-year high, suggesting a rebound brimming with confidence. But this does not show the whole picture. PMI surveys still reveal concerns about second waves and suggest weakness in hiring and capital spending plans. Retail sales omit significant elements of consumer spending, such as travel, leisure, entertainment and hospitality, where the recovery may be much more muted. Household savings rates have risen sharply in many economies as consumers remained wary, particularly among higher income households: will confidence recover enough to unlock those savings and rekindle spending beyond an initial surge of relief at the easing of lockdown, or are households – particularly more vulnerable households at the lower end of the income spectrum – right to worry about their future prospects? In the UK, one-in-six mortgage borrowers paused repayments on their loans, shoring up disposable incomes in the very short-term; the end of mortgage holidays will be a further headwind to sustained consumer spending. So much will depend on consumers’ confidence, ability and willingness to spend as lockdown eases, and that in turn will be driven by perception of job security and future prospects.

After a staggering rise in US unemployment in March, news has improved: every week, for the 12 weeks since 3 April, has seen a decline in the number of new jobless claims filed in America. Good news? Perhaps, but in every one of those weeks, even as the numbers declined, the absolute number of new claims for jobless benefits was higher than in any other week in the entire data-series, going back to 1967. Overall unemployment numbers in the US are still shockingly high, with over 19 million Americans still claiming unemployment benefit (down from over 25 million in mid-May, but in the context of a data-series that had never previously topped 7 million). The unemployment rate rose from 4.4% in March to 14.7% in April, and although it has reportedly fallen to 11% in June, these data speak of incredible disruption and uncertainty in the labour market. Over 9 million UK workers have been on furlough; that scheme is becoming less generous to workers and more burdensome for employers month-by-month until closing in November. Official unemployment rates in Britain (and European countries operating comparable schemes) have held fairly stable through lockdown, but this may be a ticking bomb of future joblessness: how many of those employees will end up unemployed rather than back at work?

Inflation remains subdued in G20 economies; this has given central bankers room for manoeuvre on monetary policy. Corporate surveys reveal excess inventories in the face of crumbling demand – a strong disinflationary force. Some investors are concerned about the longer-term inflationary impact of central bank bond purchases, with forward inflation markets ticking higher recently. The debate over inflation risks from QE has run on since the policy spread after the 2008 GFC, and will not end soon.

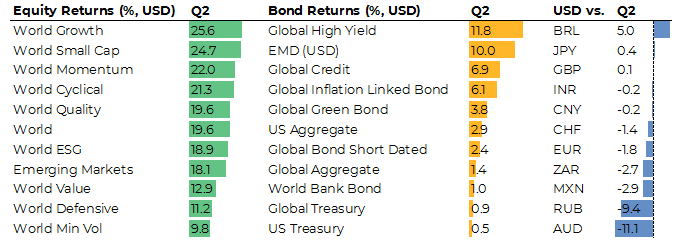

Despite the economic downturn and collapsing corporate earnings expectations, equity markets rebounded strongly, apparently confirming the lows of late March as the bottom of the COVID-19 bear market; of the current wave, at least. Every major market segment gained in Q2, from laggards like UK large caps and global low-volatility stocks (up nearly 10% in local currency) and global value stocks (+13%) to stellar quarterly returns of over 27% from US large-cap growth stocks. Commodity-sensitive markets like Australia, Brazil and Russia rebounded strongly and US small /mid-cap stocks surged 25%, outperforming the large cap US index. The performance of global sectors in Q2 carries many hallmarks of a classic recovery: defensive sectors like Utilities (+6.5%) and Consumer Staples (+8.9%) rallied quite modestly; whereas cyclical Materials (+26%) and Consumer Discretionary (+30%) stocks outperformed, trailing only the IT sector giants (+31%).

The strong performance of the US IT and Consumer Discretionary stocks (the latter driven by Amazon) both in the crash and the rebound means that US equities and global growth stocks now show year-to-date gains. Chinese equities ranked below the pack in Q2, but their resilience in Q1 means that Chinese stocks also now show modest gains for the half-year. At the other end of the spectrum, despite rallying strongly in Q2, Russia and Brazil still show significant losses for the year, with the UK – in a perfect storm of a poor response to the pandemic and rising risks of a damaging no-deal Brexit – underperforming in both the crash and the rebound, delivering returns of -17% (in Sterling terms) year to date.

Portfolios that were underweight the handful of large-cap tech stocks, that held minimal Chinese exposure, that were heavily exposed to UK equities or that bet on a long-delayed recovery of value vs growth, faced enormous headwinds to performance.

This narrow market leadership is nothing like previous broad bull market recoveries. Despite the S&P 500 approaching its February peak, over half of the stocks in the index are still down at least 20% from their highs. Thus the headline index strength camouflages significant underlying weakness.

Many investors are concerned about equity valuations. Earnings forecasts have been cut at record pace, and the S&P 500 closed the quarter on a forward price-earnings ratio of 21.8x, much higher than historic averages. However, the collapse of cash interest rates and government bond yields offers a counter-argument: even at high current valuations, equities apparently offer a chunky risk premium relative to risk-free assets.

Among many milestones in the period we might note a few as microcosms of the market trends: this was the quarter where we saw the market value of Tesla (which sold less than 400,000 cars last year) overtake that of Toyota (which sold well over 10 million); we saw the tech-heavy NASDAQ Composite index reach new all-time highs, over double its peak from the 1999-2000 technology boom; and we saw the market capitalisation of the UK fade further from the top rank - from over 4% of the world stock market at the start of 2020[1] (half that of China) to a little over 3% (less than a third of China’s). No other market saw a remotely comparable fall in relative importance.

Central bank support measures have floated all boats in fixed income. Government bonds held onto their gains from Q1 (the US 10-year Treasury ended June with a yield of 0.65%, little changed from 31st March), but riskier bonds benefitted most from central banks’ underpinning. The ECB has operated corporate bond purchases since 2016 in an effort to reduce borrowing costs for companies and thereby support Eurozone growth; while the ECB expanded corporate bond QE purchases as part of its Pandemic Emergency Purchase Programme over the past few months, it has – to date – only bought higher quality “investment grade” corporate bonds. Having announced a similar programme in late March, the US Federal Reserve announced in early April that it would add high-yield (or junk )bonds to its QE programme. This direct central bank support helped fuel a stellar quarter for riskier debt, despite rising corporate defaults: US and Euro high yield bonds both returned over 10% for the quarter, with higher quality investment grade credit and emerging market US$ bonds not far behind. Credit spreads fell sharply from the extraordinary heights seen in March: to levels associated with ‘normal’ stressed conditions.

UK inflation-linked gilts gained over 10%, after a quieter Q1, helped by a tick up in expectations for medium- to longer-term inflation in the UK. Yields on linkers have plumbed new depths: the real yield on the ten year linker means it is priced to deliver a return of RPI inflation minus 2.9% if held to maturity. Protecting against UK inflation through linkers looks like an expensive luxury.

Year-to-date, UK and US government bonds (led by UK linkers) now show the strongest gains, but investment grade corporate bonds are also in positive territory for 2020 so far, and losses are now reasonably modest for the riskiest categories of junk and emerging market bonds.

Current low yields present a dilemma: how to build a portfolio to deliver a healthy long-term real return when low-risk assets offer a yield well below the rate of inflation. This unavoidable reality has driven much recent investor behaviour – reaching for returns in riskier, more illiquid and more exotic assets – and seems set to continue.

With extreme moves in both equity and bond markets, it’s perhaps surprising that currency market moves were more muted in Q2. Shifting risk appetite was the biggest driver, with the safe-haven US Dollar weaker against most majors (except Japanese Yen and the Pound). In a risk-on environment, the battered commodity-related currencies trimmed their losses: Australian and NZ Dollars and Norwegian Krone all strengthened at least 8% against the US Dollar in the quarter and most emerging market currencies gained, led by Indonesia, Russia and Colombia. The Pound was broadly flat against the Dollar in Q2 and still stands around 7% weaker year-to-date, undermined by Brexit risk and government mis-steps in response to the pandemic. For UK investors, holding unhedged overseas asset exposure has again been helpful.

After the extraordinary conditions in March, where some oil futures dipped into negative territory, energy markets have regained some poise. Producers agreed to cut output sharply; and demand stabilised alongside partial easing of lockdown measures, particularly in China. Crude oil traded around $40 a barrel at the end of the quarter. At these relatively low oil prices we may still expect to see retrenchment among some producers. But lower oil prices also represent a potential boost to consumers’ disposable income.

Safe havens like gold and silver have continued to perform. The gold price rose almost 13% in Q2, ending the quarter at $1775/oz, close to its all-time-highs. While this performance by a safe haven asset may seem inconsistent with recovering investor risk appetite, a weakening Dollar and falling real bond yields are supportive for gold.

While the fight against COVID19 dominates headlines and market sentiment, its dominance is less total than was the case three months ago: investors have found enough bandwidth to regain some focus on other risks and market drivers, in particular political questions in the US and UK, as we move towards the Presidential election and the end of the Brexit transition period.

The June 30th deadline for the UK government to request an extension to its Brexit transition arrangements has now passed. The UK now has under six months to agree terms with its largest trading partner, or exit with “No Deal”, risking further economic disruption. Sterling’s weakness in Q1 and the weakness of UK equities throughout Q2 reflect investor caution. An acceptable deal may yet emerge, or an expedient way might be found to extend transition, but this uncertainty is clearly deterring investors.

The US Presidential race is never over until the votes are counted, so it’s wrong to talk of Biden holding an unassailable lead, but polls have moved through the quarter to suggest a clear margin as we write: Biden leads the presidential election polling by 9%, and Trump’s approval ratings have fallen to near the lowest levels of his Presidency. Biden’s polling shows modest but consistent leads in key battleground states like Florida, Pennsylvania and Wisconsin, and we have to go back to mid February (pre-COVID, of course) to find a single reputable nationwide poll that puts Trump ahead. Markets should already be pricing in a high probability of a Biden Presidency in November, and a fair chance of a Democratic sweep in Congress. A Democratic sweep may raise investor concerns over increased taxation and regulation; but also suggest opportunities from increased spending on infrastructure and on green energy.

We end the quarter with buoyant stock markets, driven by the surge in the tech giants, contrasting with wary investors: wary about a resurgence of the virus; wary about equity valuations and the outlook for corporate earnings; wary about the expansion of government debt and the prospects for financial market returns in a world of near-zero interest rates; and wary about the sustainability of the economic recovery. So much rests on sound policymaking, in the arenas of monetary, fiscal and public health policy, in the months ahead.

Subscribe to our mailing list to get the latest insights, news and market updates delivered direct to your inbox.