Sign up to our newsletter

Subscribe to our mailing list to get the latest insights, news and market updates delivered direct to your inbox.

When the history of the pandemic is written, the first quarter of 2021 may be seen as the tide turning, with mass vaccinations underway. From the UK, some might see the worst as over: half the population has received a first vaccine, and cases are down 90% from January’s tragic peaks, while the economy progressively reopens.

We can celebrate the UK’s vaccine rollout success, but the pandemic is still raging globally. The first quarter of 2021 was the deadliest yet, with a million deaths. The winter surge abated, but a new wave has pushed daily infections above 600,000. Cases are rising in the US, Brazil, France, India and Turkey; these five countries account for nearly half of current daily infections, exacerbated by new variants. The UK is reopening, and much of America remains open for business (helped by stunning recent progress on vaccinations), but across Europe, new lockdowns are starting.

Markets look ahead to life after lockdown, when COVID-19 may become a manageable risk. They foresee resurgent consumer spending, reflating the economy, and rotating back into services like travel, entertainment and hospitality.

The rebound in 2021 could see the highest growth for decades: consensus expects world GDP expansion around 6%. Consumer confidence is rebounding, and PMI surveys indicate strong manufacturing activity across much of the world, with surging new orders and booming export demand. Services businesses have faced particular challenges under lockdown, but indicators are improving. The US Services PMI shows the strongest upturn in activity since 2014, European Services PMIs are stabilising, despite lockdowns, and Services businesses in Britain report a healthy recovery. China is moving to its own rhythms, with signs of slower domestic growth momentum in recent months, but Chinese firms highlight strong overseas demand.

Businesses everywhere are seeing cost pressures: raw material shortages, longer supplier deliveries, rising energy costs and wage bills. However, demand is strong enough that firms can increasingly pass on price rises. Many investors worry that policymakers’ continuation of emergency support risks inflationary consequences.

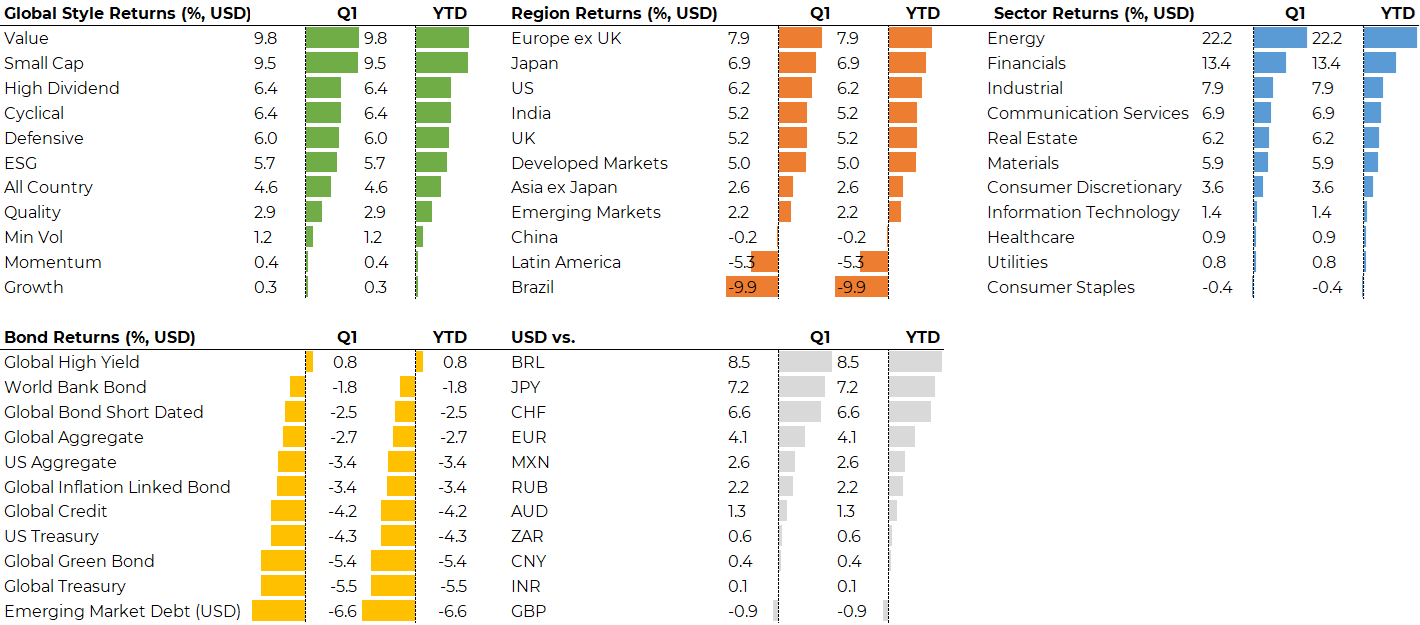

Market behaviour has been skittish: volatility spikes, violent rotations and sharp rises in government bond yields. Although equities advanced again (global stocks rose nearly 4% in Sterling terms in Q1), choppy bond markets undermined traditional “balanced” portfolios. Of course, many investors have long since moved away from government bonds, diversifying into alternative assets or more esoteric bonds. But holders of conventional government bonds saw significant losses: US Treasuries lost 4.3%, Gilts lost 7.4%. It was the worst quarter for Treasuries since 1980; so much for supposed “safe havens”.

Rising bond yields are both symptom and cause; symptom of rising growth and inflation expectations, as well as cause of violent rotations in equities and currency markets.

Inflation concerns mean that longer maturity bond yields rose much more than shorter bond yields, which are anchored by central banks. This means steeper yield curves and much bigger losses for longer maturity bonds. Losses for inflation-linked bonds were more limited, with their “inflation-linked” element becoming more valuable. Most corporate bonds saw losses: although optimism about borrowers’ creditworthiness increased, this couldn’t outweigh the effect of rising Treasury yields, except for high risk, shorter maturity “junk” bonds, which made small gains.

Equities’ performance, since the pandemic trough in March 2020, is stunning; among the best twelve-month gains ever seen. Global stocks progressed to new record highs in March, gaining 5% in Dollar terms for Q1, but this conceals violent currents. Steeper yield curves classically indicate Value outperforming Growth: this played out, with the Nasdaq retreating 10% from its February peak, Growth stocks overall flat for the quarter, and Value stocks gaining almost 10%. This only fractionally unwinds Growth’s recent outperformance but was challenging for investors who had not prepared for rotation.

Steeper yield curves tell us investors expect the economy to run hot, with cyclical industrial earnings rebounding, and commodity prices strengthening. Indeed, oil prices almost doubled from October to March, and Global Energy was the strongest equity sector, up 22% in Q1 in USD terms. Global Industrials gained nearly 8%. Steeper yield curves also support bank earnings, and a stronger economy reduces loan losses: Global Financials gained over 13% in Q1. Conversely, higher bond yields detract from defensive “bond proxies”, like Utilities and Staples (flat in Q1), and undermine growth company valuations. Global Technology, after gaining 40% in 2020, rose only marginally in Q1. It’s notable that markets advanced without a contribution from Tech.

Stocks in Europe, the UK and Japan performed well, in local currency. These markets have low exposure to IT and high weightings to cyclical and value sectors. British stocks matched US indices (in Sterling terms), helped by Energy, Financials and strong domestic mid-caps, boosted by vaccines. UK equity funds experienced record inflows in March.

However, rising Treasury yields lifted the Dollar: it gained 4% vs Euro, 7% vs Yen and strengthened against most emerging market currencies. Sterling rose strongly too, helped by vaccine progress and relief that no-deal Brexit was avoided. For UK and US investors, currency losses largely offset underlying gains on Japanese, European and Emerging equities. Some oil or commodity-related markets performed well (Brazil was an exception again). Saudi Arabian and UAE equities rose 15-16% in Dollar terms, and Chile gained 17%. Chinese equities were essentially flat for the quarter, after such a strong 2020.

Gold’s reversal from last summer’s surge continues, falling almost 10% in Q1. Inflation concerns aren’t enough to counter headwinds faced by gold: higher real bond yields undermine an asset without cashflows; the US Dollar has strengthened; and vaccines mean catastrophe risk has abated. Investors have favoured another non-cash asset instead: despite extreme volatility, Bitcoin continues attracting interest. It doubled again, from $29,000 to $58,000 in Q1.

How seriously should we take markets’ inflation concerns? Transient price pressures seem baked in, as demand recovers and commodity prices rebound, but sustained inflation looks less likely: the economy is recovering, but with 8 million fewer Americans employed than in February 2020, and structural disinflationary forces persisting, the conditions do not exist for a serious wage-price spiral. QE may drive asset price inflation, but in 12 years of QE since the Global Financial Crisis, consumer price inflation has not taken off. We should be wary of expecting it now.

Central banks remain committed to emergency support measures: the ECB has accelerated QE and the US Federal Reserve suggests no rises before 2024. Markets are doubtful, pricing in rate increases in 2022/23, but the Fed remains committed. Markets expect the Fed’s QE to adjust first, perhaps signalling later this year that it’s confident enough to “taper” purchases, or “twist” into longer maturities. Markets remember 2013’s “taper tantrum” sell-off in stocks and bonds; policymakers may approach any announcement carefully to avoid a repeat.

Extraordinary monetary and fiscal policy helped to avert collapse and sparked stock market recovery a year ago. Biden’s White House now aims to be even more ambitious. The $1.9tn American Rescue Plan was passed in March, bringing direct $1400 payments to most Americans, and many other measures. Biden now proposes a historic $2.2tn infrastructure package, covering electric vehicles, sustainable housing, broadband, rail and more: far larger than packages recent administrations have trailed yet failed to deliver. Planned corporate tax hikes to fund expenditure will meet serious opposition but could ease inflation concerns: they make the package redistributive rather than purely inflationary. The bill faces a long, bumpy route through Congress, but if passed in some form, it offers a significant boost across many sectors.

Investors who hung on through the pandemic have been rewarded with historic gains, pushing stocks well above pre-pandemic peaks. Unsurprisingly, some now worry about frothy markets: volatility in retail-led stocks; hedge fund collapses rippling through counter-party banks; and exploding IPOs of Special Purpose Acquisition Companies (SPACs), floated to purchase private companies. Some see this as late-cycle excess in an extended bull market, a dangerous combination with rising bond yields and demanding valuations. Others simply see early reflation and rotation in a developing bull market with plenty of headroom as the COVID recovery unfolds and household spending is unleashed, with policymakers relaxed about letting the party continue. These opposing views suggest scope for plenty of volatility to come.

Subscribe to our mailing list to get the latest insights, news and market updates delivered direct to your inbox.