What a difference a quarter makes; volatility is down, oil is up, credit spreads have narrowed, and equities have surged.

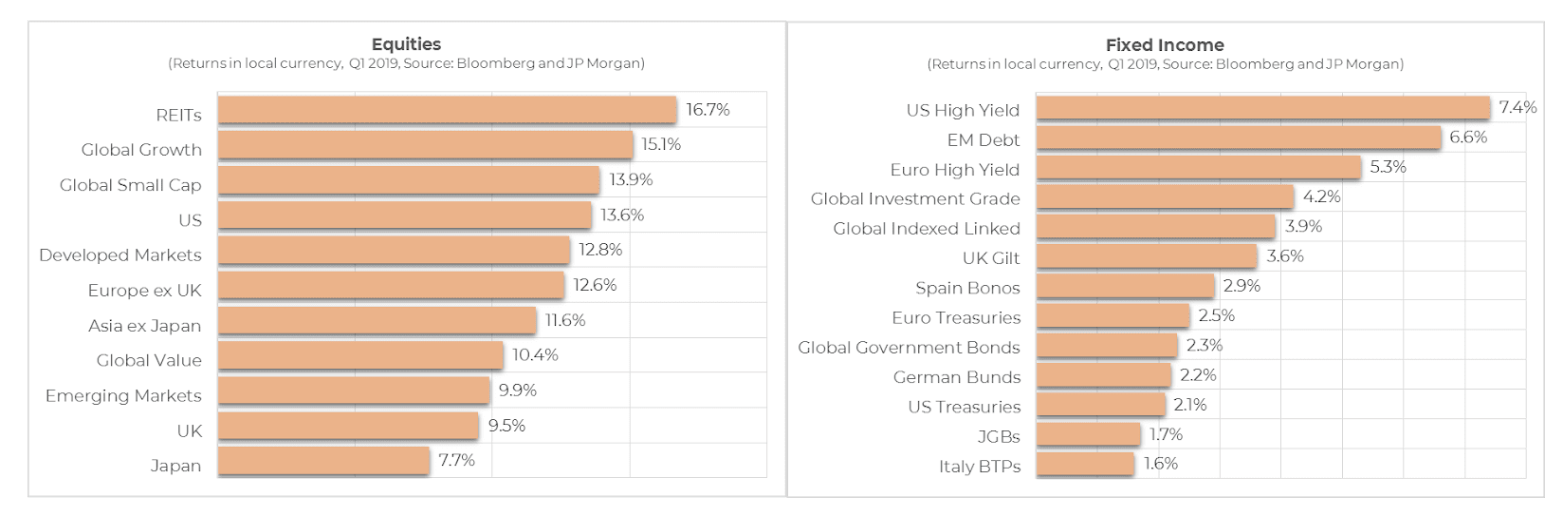

Global equities rose 13% in the first quarter of 2019, reversing the steep equity market declines of late 2018. The ‘V’ shaped recovery in stock prices, credit and commodities was due to the volte-face on monetary policy by the Federal Reserve and to a lesser extend the hope of a trade deal between the US and China. Within Global equities, small caps outperformed large caps and growth outperformed value. The best performing equity style category was Small Cap Growth. By region, US equities were the best performer up 14% and the worst performer were Japanese equities which returned 8%.

Fixed income returns were positive across the credit and maturity spectrum. Unusually, credit and rates both delivered strong returns. Investment grade and high yield spreads narrowed sharply by around 40bp and 130bp respectively, whilst US Treasuries continued to rally with yields falling a further 30bp (which is nearly a 100bp move since Q3 2018). The fact both credit and rates rallied together implies a lower more benign inflationary outlook than anything more sinister.

The charts below show the extent of the 'risk on' rally over Q1 2019.

Sterling was the best performing G10 currency over the quarter, up nearly 3% against the USD. Reflecting the strong rebound in Sterling due to an increasing probability that a ‘no deal Brexit’ will be avoided. Traditional safe haven assets such as the Swiss Franc, Japanese Yen and gold fell slightly against the USD.

In October last year, just after the Federal Reserve’s eighth rate hike in two years, President Trump said “…The Fed is going wild. I mean, I don't know what their problem is that they are raising interest rates and it's ridiculous… The Fed is going loco and there's no reason for them to do it”. These comments received worldwide ridicule. Three months later, the Federal Reserve hiked interest rates for a ninth time and markets suddenly sided with President Trump and were in free fall. The fear in the markets was that the Federal Reserve was ignoring problems overseas, particularly the ongoing slowdown and turmoil within the emerging markets.

On the 4th January 2019, at the annual meeting of the American Economic Association, Chairman Powell flanked by previous Federal Reserve Chairs Ben Bernanke and Janet Yellen, gave a speech in which he effectively admitted ‘mea culpa’. The new dovish tone at the Federal Reserve was set; the committee would remain patient and data dependent with regards to further rate hikes and be prepared to alter the balanced sheet normalisation process. Markets immediately understood the Federal Reserve was now hold for 2019 and even began pricing in the possibility that a rate cut would be the next move in policy.

The reason for the change in monetary policy stance was market and data driven and not through the coercion of President Trump. The Chicago Fed National Activity Index, a weighted average of 85 US economic indicators covering employment, housing, investments, retail and manufacturing, had started to decline. The three-month moving average has fallen continuously over the quarter, signalling a slowdown but not a recession. Moreover, despite the 34% rally in oil prices, inflation remains weak and long-term expectations of inflation have fallen.

It is not just the Federal Reserve. The European Central Bank pushed back the timing of a rate hike and launched another round of TLTROs (subsidised loans to European firms) because the Eurozone is flirting with recession. This effectively means the European Central Bank will not be able to normalise monetary policy this cycle and President Mario Draghi will retire in October with rates still negative and inflation below target. Within emerging markets, India was the first central bank to cut rates to boost demand and others may well follow suit as the Federal Reserve is on hold.

Central banks globally this quarter have on mass shifted policy to easing. While this has been good so far for risk assets, they have done so because the global economy is slowing.